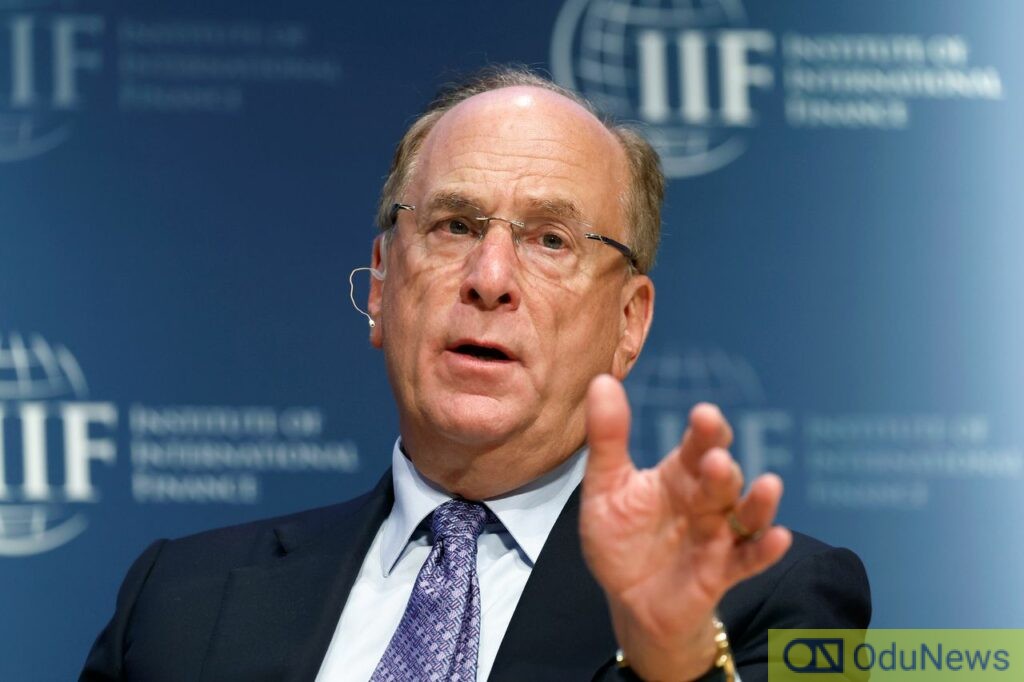

Larry Fink, the founder of BlackRock, has expressed optimism about the potential of artificial intelligence (AI) to address the ongoing productivity crisis and alleviate persistently high inflation rates. Speaking at BlackRock’s investor day, Fink emphasized that AI has the power to enhance productivity, leading to improved margins across various sectors. He highlighted AI as a technology that could play a crucial role in curbing inflation.

Fink has consistently cautioned that elevated inflation could prompt the US Federal Reserve to resume interest rate hikes later this year.

In his remarks, Fink mentioned his affinity for dystopian movies and shared that BlackRock, with its $9 trillion assets under management, would approach investments in AI with a “healthy paranoia” and “healthy enthusiasm.”

Additionally, Fink stated that BlackRock, as the world’s largest money manager, continues to explore acquisitions that can expand its global footprint, enhance its technological offerings, and increase its presence in private markets. The chief executive emphasized their commitment to reimagining the business model and highlighted BlackRock’s history of disruptive innovation that has shaped its current position and will drive future growth.

During the event, Fink and other executives did not directly address the criticism leveled at BlackRock by “anti-woke” Republican politicians in the United States. However, they reiterated the financial opportunities stemming from investments in the energy transition.

BlackRock aims to achieve a 5% annual increase in revenue, setting aggressive targets for its Aladdin technology business and its relatively smaller yet high-margin private markets segment.

Furthermore, the company announced a partnership with Avaloq, a Swiss provider of banking software owned by Japan’s NEC Corporation. BlackRock plans to make a minority investment and integrate the technology with its Aladdin offering, catering to wealth managers.

Executives at BlackRock also anticipate capitalizing on the trend of insurance companies, endowments, and pension funds streamlining their manager relationships and potentially outsourcing their entire portfolios to a single firm. Since 2019, BlackRock has secured 20 such “mega-mandates,” each valued at a minimum of $5 billion.

Chief Operating Officer Rob Goldstein noted that clients are consolidating their providers and increasingly relying on BlackRock to fulfill their investment needs.

The company aims to double its revenue from private markets within five years, targeting a growth trajectory from the current level of $1 billion. To support this goal, BlackRock recently restructured its leadership roles, differentiating private credit and multi-asset funds from traditional private equity. It manages $320 billion in alternative assets, including $156 billion in private markets, with the remainder allocated to hedge funds and liquid credit.

While critics express concerns about BlackRock’s size and influence, several speakers at the event argued that the asset management industry remains relatively fragmented and unconcentrated.

Mark Wiedman, Head of Global Client Business, addressed perceptions of BlackRock’s scale, highlighting that even with the projected developments, the company would still account for only 3.1% of the total market.

Submit press release, news tips to us: tips@odunews.com | Follow us @ODUNewsNG