The Central Bank of Nigeria has urged the Organised Private Sector (OPS) to bring in their foreign exchange proceeds back to the apex bank to stabilise the FX pressure in the country.

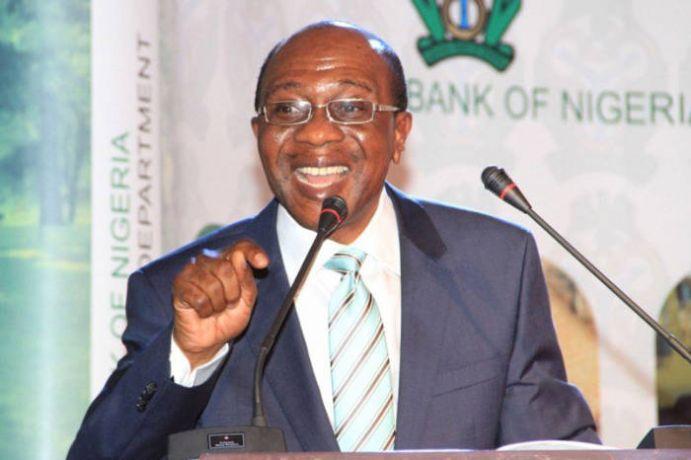

The Deputy Director, Banking Services, CBN, Egboagwu Ezulu, made the call at the maiden stakeholders’ conference of the Association of Corporate Affairs Managers of Banks (ACAMB) on Wednesday in Lagos.

Ezulu advised OPS to take advantage of the various intervention schemes of the CBN to through the Bank of Industry, the Development Bank of Nigeria and commercial banks, to boost their output.

“We are taking FX out of this country and dumping offshore; when we were told to bring them back. If Nigerians are bringing back FX, we would not be talking about the challenges of FX. There is a challenge for individuals and businesses to do the right thing,” Ezulu said.

“That is why the CBN introduced the RT200 to encourage you to bring back the dollar you are saying is scarce, but in the books of the banks we see billions of dollars that have been exported out of the country and the OPS are not bringing it back, so how do we finance FX demand?”

Speaking on how OPS could get funding for output: “When you talk about financing small businesses, the CBN has done a lot of funding to the sector alluding to trillions of naira and has established two entities for this purpose. Has the manufacturing sector approached the entities for the funds available rather than emphasising on the commercial banks?

“The manufacturing sector should put pressure on the Bank of Industry and Development Bank of Nigeria to source funds, and when we see a lot of pressure from those two entities, the CBN instead of going through commercial banks would push those funds to those two entities rather than going to the commercial banks who would give double-digit loans.

“I want to appeal that industrialists and small businesses should approach those two entities to get funding.”

On his part, the President of the Nigerian Chambers of Commerce, Ide Udeagbala said: “The organised private sector breeds a vibrant economy for sustained, inclusive economic growth and development. Therefore, there is need for the banking sector to further enhance investments by identifying and funding good business opportunities and facilitating the exchange of goods and services as a means of contributing to the growth of the private sector. For this role, you will find a worthy partner in the organized private sector.”

In his welcome address, President of ACAMB, Mr Rasheed Bolarinwa said: “To the extent that financial intermediaries are crucial to economic growth, there is bound to be a meeting point between OPS and the banking sector.

“From available communication research efforts, there seems to be a mutual misunderstanding between the two sectors, and all efforts to streamline this perceived gap have not been totally successful.

Comments are closed.