For six years, Emma Warren has remembered the moment that she was told she owed $8,000 to the government.

Highlights:

- A royal commission into the unlawful Robodebt scheme was announced this week

- $750 million is being wrongly taken from Australians

- Robodebt wounds still remain open six years later

- She felt like she couldn’t breathe:

The woman was shocked when they refused to offer her disability benefits. They had always done the right thing and believed it would give them the pay they deserved.

A 46-year-old woman with Crohn’s Disease, Epilepsy, and Disability Support Pension

A researcher and tutor at the University of Newcastle, she became too unwell to continue working at the university in 2015.

Quote “To be saddled with the burden of a debt of $8,000 when you are unable to work, it was just crushing,” said Ms Warren.

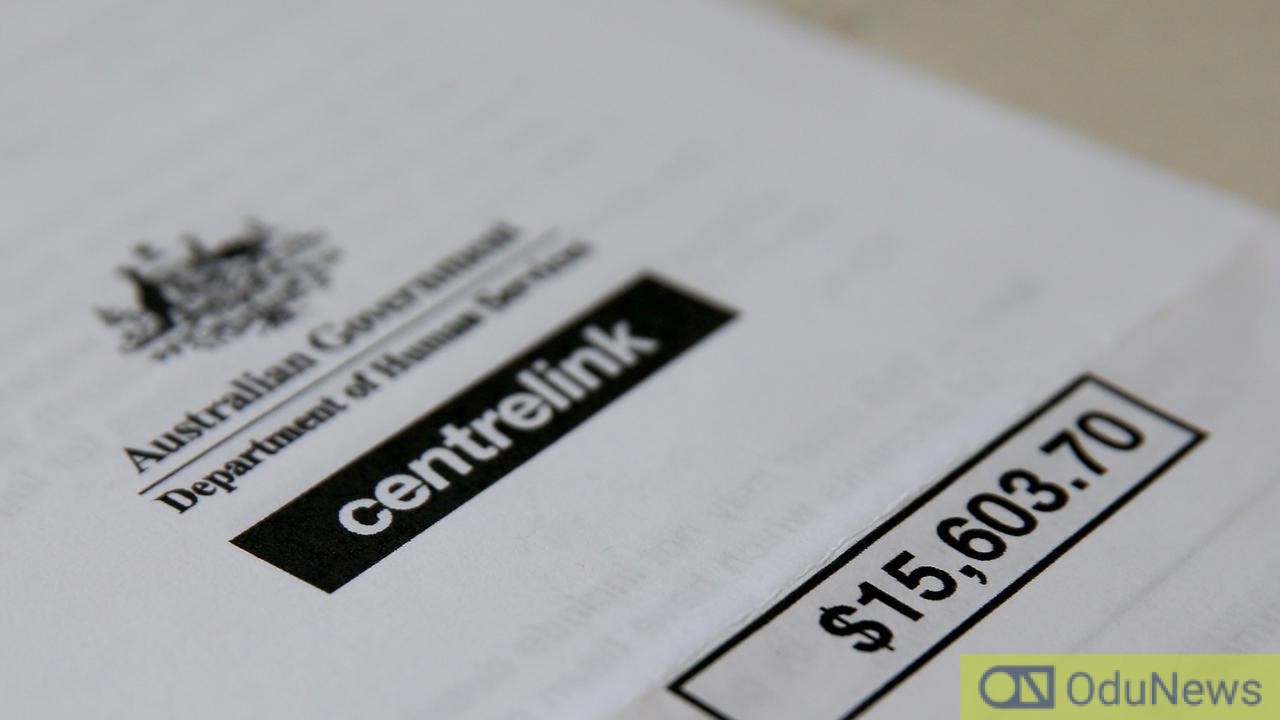

An automated debt recovery program called Robodebt began around that time. It was later ruled unlawful.

The ABC encourages all listeners to share their stories

The program is being conducted by the government, who will send debt notices to hundreds of thousands of Australians. One person this program is effecting is Lindsay Warren.

The current federal government announced a royal commission into it this week.

Even though it has been decades since Ms Warren was scammed, she still gets an irritating feeling when she hears about her payment or hears about the words “myGov”, “Centrelink” or “Robodebt”.

A woman with a big fluffy scarf on is standing outside her house

Emma Warren says being hit with her $8,000 Robodebt was “crushing”.(ABC News: Andrew Lobb)

She said she and people she knows who received Robodebt notices feel “marked”.

“I really worry that there will always be an air of suspicion around people like myself that had these debts raised against them,” she said.

What was Robodebt?

The Robodebt system automates the process of checking Centrelink recipients’ reported income against their tax records to identify instances where they may have been overpaid.

There were serious problems in the past of which we have been able to resolve

The automated system can not pick up on nuance as well as the previous person-led approach.

Automation means that AI is responsible for fewer mistakes, so some protection against flaws in the algorithm is necessary.

The onus of proof was reversed from Centrelink to proved the debt, rather than the debtor having to prove that they did not owe the debt.

Be VERY careful if you wind up on such a list! The government is collecting money that belongs to others, and taking it from taxpayers in the process.

Ms Warren says that her loans were calculated erroneously and believes it is because an identical scholarship payment was counted as income. This would be an incorrect deduction from earnings.

She said her anxiety soared over the 2015 Christmas period when she was contacted by a debt collector, but couldn’t get a hold of anyone at Centrelink until after the holidays.

The woman spoke to someone at Centrelink, who said that the debt collector should not have called her because the company realized that she was in the wrong.

“Because there weren’t actually humans involved in checking and looking further, mistakes … weren’t picked up,” she said.

Ms Warren said her debt notice didn’t include many specifics, essentially only that she owed money and had to pay it back.

Leah Wheaton remembers an office visit where a middle-aged man clad in a suit was on his knees, asking staff where his debt came from.

The writer recalls feeling the same despair felt by people when their last resort for food, rent, and medicine is taken away from them.

“It’s soul-crushing.”

The federal court approved a settlement $1.8 billion last year, with the government compensating victims at the cost of $112 million.

Ms. Warren has regained her stolen funds, but there is still no sign of compensation for the prolonged stress she went through.

Comments are closed.