WASHINGTON DC – On Friday morning, many Wells Fargo customers reported missing money from their online banking accounts, leading to widespread frustration and concern. According to reports, some customers saw incorrect balances or missing transactions in their accounts, which the bank attributed to a technical issue.

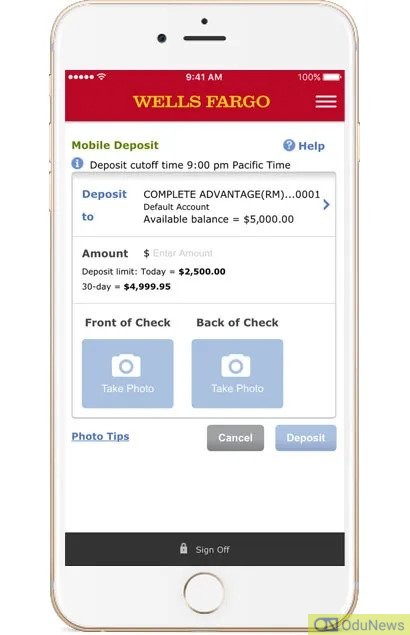

Wells Fargo issued a notice in its mobile app, reassuring customers that their accounts remained secure and that the bank was working quickly to resolve the issue. As of 9 a.m. Eastern, the bank had not yet addressed the issue publicly beyond the mobile app notice.

Meanwhile, customers took to social media to express their concerns, with some reporting missing direct deposits and scheduled paychecks, putting their accounts at risk of overdrafting.

The issue was also noted by Downdetector, a website that tracks online outage reports submitted by users, which indicated a spike in Wells Fargo issues around 8 a.m. Eastern.

It remains unclear how many customers were affected by the issue or when it will be resolved. Wells Fargo has not yet provided further comment on the matter.

The incident highlights the importance of maintaining secure and reliable banking systems, particularly in an increasingly digital and online age. It also underscores the need for banks to promptly address and resolve technical issues to maintain customer trust and satisfaction.

Comments are closed.