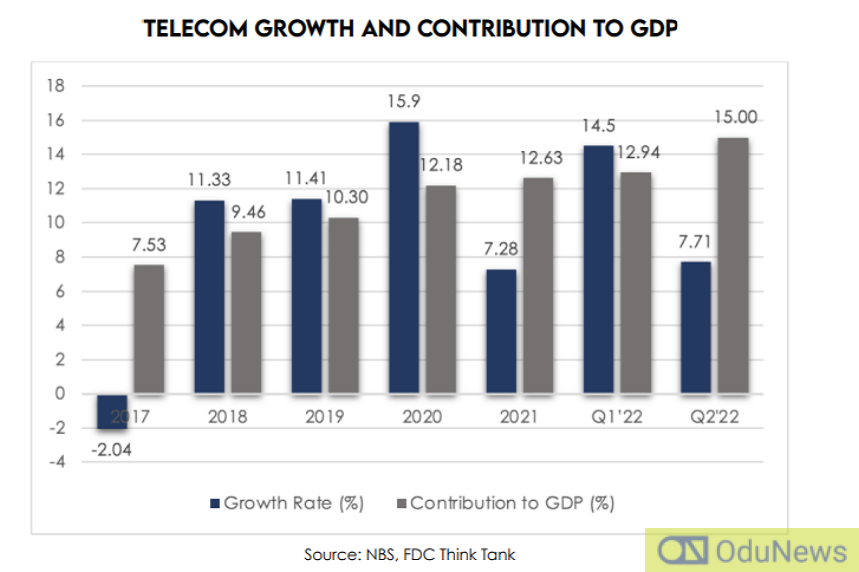

Nigeria’s telecom sector has shown resilience and fortitude since the deregulation of the sector in the early 2000s. In terms of subscriber base, it is the third largest telecom market in Africa, after South Africa and Egypt. The sector has posted impressive growth since Nigeria exited recession in 2017. In fact, during the pandemic year (2020), the sector grew by 15.90% with a GDP contribution of 8.73%.

In May 2022, the FGN proposed a 5% telecoms tax – a new tax on the telecommunications sector, a minimum of one kobo per second for every phone call generated. The tax was introduced in the new National Health Insurance Authority (NHIA) Bill 2022 where it was listed as a source to finance the Vulnerable Group Fund. This sparked a public outcry. Telecom players condemned the multiple taxes the sector has been battling with. Resultantly, the voice call tax was expunged from the NHIA bill that was finally signed by the president.

Nigeria’s healthcare sector and the new NHIA bill

Nigeria’s healthcare sector has at best remained stagnant, if not deteriorated. As of February 2018, Nigeria was ranked 187 out of 191 countries in the world in terms of compliance with its Universal Health Coverage, as only a minority of the population was covered by health insurance. In general, the government’s provision for health has been insignificant, with its healthcare expenditure at only 25.15% of all health expenditures. Private care, by comparison, accounts for 74.85%. Out of the 74.85% of private expenditure, 70% is out-of-pocket payments which put a major strain on Nigerians. More than 50% of Nigeria’s citizens live on less than $1.90 a day, making it one of the world’s poorest countries. Many Nigerians are also unable to afford or access basic treatment and have to look to alternatives, which pose danger to their lives and can result in death.

The Nigerian government established the National Health Insurance Scheme in May 1999, which covered government employees, the organized private sector, and the informal sector. Through legislation, the scheme also included children under the age of five, people with permanent disabilities, and inmates in prison (otherwise known as vulnerable groups). However, in 2015, under 5% of Nigerians had access to health insurance coverage.

The National Health Insurance Act 2021 sets out to improve Nigeria’s healthcare sector and repeals the National Health Insurance Scheme Act 2004. The act empowers the NHIA to carry out a broad range of regulatory and promotion functions, ensuring that every Nigerian has access to quality and affordable health care. Section 26, sub-section 1c of the Act states that the Vulnerable Group Fund’s financing sources include a “telecommunications tax, not less than one kobo per second of GSM calls”.

Telecom Excise tax suspended to bolster growth and expansion

In July, the FGN announced the introduction of an exercise tax on all telecom services, including calls, SMS, data and other services. The telecom players, and indeed the entire ICT sector rejected the proposed tax. Telecom companies complained that large and multiple taxes imposed on the sector stymie investment, particularly in the countries’ extensive rural areas, where expanding the network is extremely costly for telecom providers. This is detrimental to economic growth as a 10% increase in mobile broadband penetration in Africa would increase by 2.5% of GDP per capita.

Furthermore, when taxes are passed on to consumers, the availability of a substitute may induce them to change their spending habits. In this case, the substitute is voice over internet protocol (VoIP) communication (e.g. WhatsApp, Telegram, and others), which is already cheaper to use than a standard call. Any increase in per-call rates is likely to encourage consumers to choose these platforms over traditional calls. This could result in a decrease in the government’s projected revenue.

However, proponents of telecom tax cited other climes where these taxes prevail. In Guinea-Bissau, a nation of 1.8 million people, where tax revenues do not exceed 9% of GDP, a special tax on the telecommunications sector was introduced in 2021. It was imposed on a variety of services, including phone calls and mobile data, and was set at five central African francs per minute for voice calls, or 5% of the cost of mobile data services. In Equatorial Guinea, a nation with 1.4 million inhabitants and tax revenues of 7% of GDP, a tax that levied 10% of all telecommunication services was introduced in 2020. Other African countries that levy this type of indirect tax include Senegal, Ivory Coast, Uganda, and Zimbabwe. 8 This pattern of growth restrictive taxation is also present in Nigeria where about 40 different taxes and levies are imposed on the telecommunications industry by various states and local governments.

To an already stretched Nigerian consumer who is gasping for survival, any suggestion of a new tax is a kiss of death. This is why any move for an excise tax on calls and data was an unwelcome initiative. The minister of communication took it upon himself to intervene and he kept his word: the telecom tax has been suspended. The suspension bodes well for both telecom players and telephone users. Although Nigeria needs to diversify its revenue base, the fiscal policy managers must be circumspective in the way they impose new taxes.

Source: FDC Ltd

Culled from Proshare

Submit press release, news tips to us: tips@odunews.com | Follow us @ODUNewsNG